Want to know how things are performing with the economy, labour market and commercial property market right now? Then read on …

- Job market pressure easing

- Australia v rest of world

- Commercial property sales fall

- Pay taxes or else: ATO

Read more below.

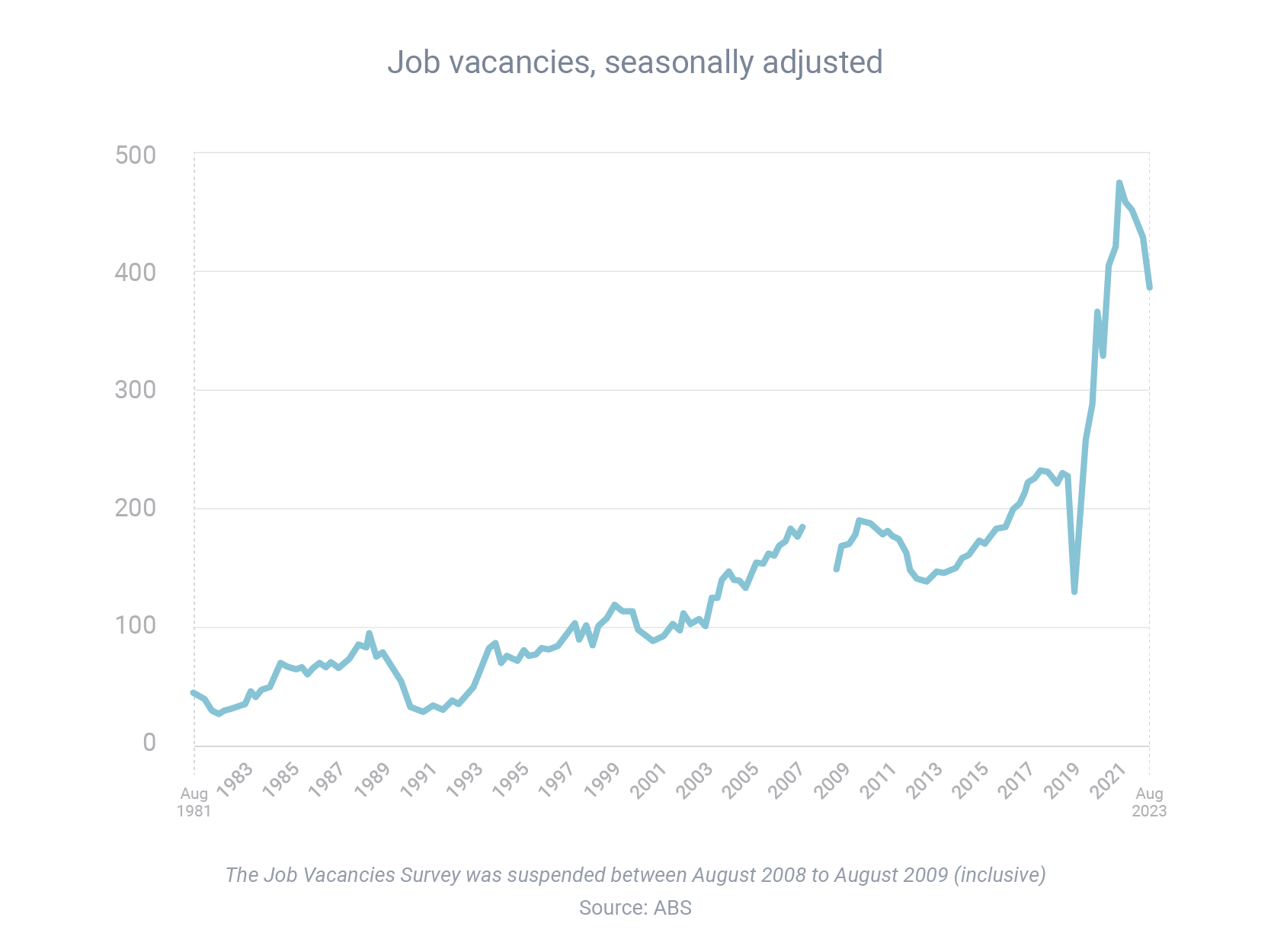

There are now 1.4 unemployed workers for every 1 vacant job

As the unemployment rate has ticked up over the past three months, there’s also been an increase in the gap between the number of people without a job and the number of available jobs.

Between May and August, the unemployment rate increased from 3.5% to 3.7%, according to the Australian Bureau of Statistics. At the same time, the number of unemployed workers for every job vacancy increased from 1.2 to 1.4.

- May = 512,800 unemployed, 428,400 vacancies.

- Aug = 539,700 unemployed, 390,400 vacancies.

The Reserve Bank board, at their October monetary policy meeting, noted that the labour market appeared to have “reached a turning point”, with unemployment appearing to be trending up, according to the meeting minutes.

“Members also discussed hours-based measures of spare capacity in the labour market, as hours worked by current employees are often a key margin of adjustment as conditions in the labour market soften. Hours-based unemployment and underemployment rates had both ticked up in recent months from their lows reached in late 2022.”

Australia outperforming many other economies

Australia is likely to have a stronger budgetary position in 2023 than most other countries, despite running an overall deficit, according to forecasts from the International Monetary Fund (IMF).

Australia’s general government budget balance – which combines the budgetary positions of the federal, state and territory governments – is expected to be -1.4% as a share of GDP for 2023.

That compares to -5.2% for the global average and -6.5% for the G7 group of countries, which contains seven of the world’s largest economies.

Meanwhile, Australia recorded a $9.64 billion trade surplus in August, according to the Australian Bureau of Statistics.

That was the 68th consecutive month in which the value of our exports exceeded the value of our imports.

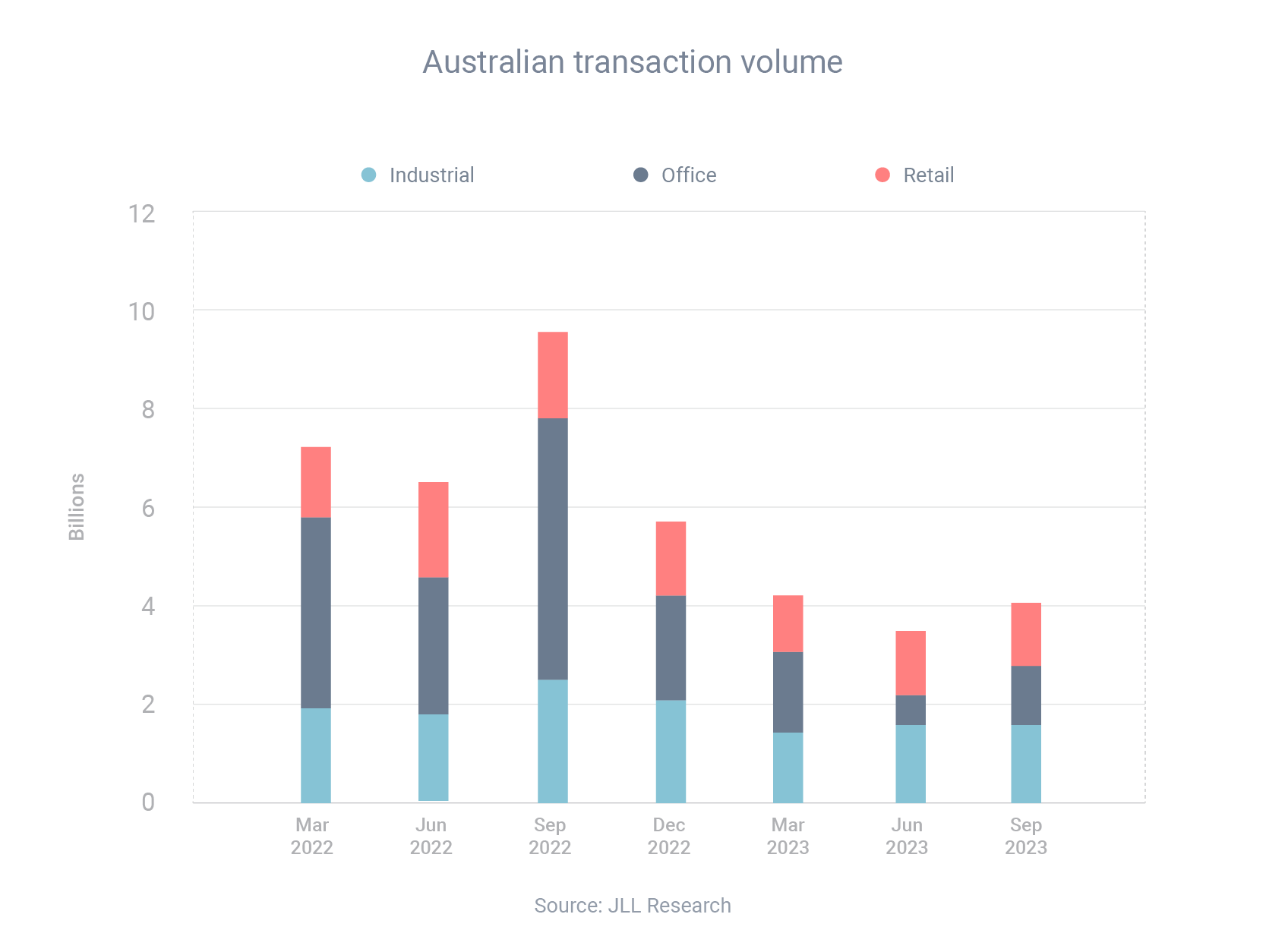

Sales fall year-on-year for all three major commercial property categories

Commercial property sales volumes rebounded slightly in the third quarter of this year, although sales activity was significantly lower than the same time in 2022.

There were $4.0 billion of sales in the office, retail and logistics & industrial sectors during the three months to September, according to JLL.

That was a 14% increase on the $3.5 billion of sales recorded the previous quarter. But it was a 58% decrease on the $9.6 billion of sales in the third quarter of 2022.

Year-on-year sales fell in all three sectors:

- Office: down 77% to $1.2 billion.

- Retail: down 29% to $1.2 billion.

- Logistics & industrial: down 38% to $1.6 billion.

“The fall in transactions since the beginning of 2023 is indicative of the pricing discovery in the market as a result of rapidly changing funding costs and a low-leverage environment relative to other global markets that prolongs this period,” JLL’s Australasian Head of Capital Markets, Luke Billiau, said.

Pay your taxes or suffer the consequences, says ATO

The Australian Taxation Office (ATO) has threatened businesses with a powerful weapon if they don’t meet their tax and superannuation obligations.

The ATO said it may disclose the debts of such businesses to credit reporting agencies, which could affect their credit score and ability to qualify for loans. To prevent disclosure, businesses needed to pay their debt or enter into an appropriate payment arrangement within 28 days of receiving an intent to disclose notice.

About 50,000 notices of intent were expected to be issued in the 2023-24 financial year, according to the ATO.Assistant Commissioner Jillian Kitto said the tax office wanted to work with businesses to help them get on top of their debts.

“We give businesses ample opportunity to re-engage with us. However, those who show continued and ongoing disregard for their tax and super obligations will have their debts disclosed,” he said.

“Through the pandemic we shifted our focus from debt collection to stimulus payments and assistance with tax, but it is now time to re-establish the culture of paying tax on time.”